Mobile App Development

KVB E - Book

The KVB E-Book app was developed as a green initiative by Karur Vysya Bank to provide customers with a seamless, paperless platform for managing non-financial banking transactions. The app enabled users to access account details including deposits, loans, utilities, service requests, and more - anytime and from anywhere. With an intuitive tab-based interface, users could navigate between different banking sections and retrieve up-to-date information with ease.

What was the main challenge in this project?

Karur Vysya Bank aimed to enhance customer convenience without compromising on security. The main challenges involved ensuring secure login mechanisms, providing a comprehensive yet user-friendly interface, integrating various banking modules such as rewards, alerts, and insurance, and enabling real-time notifications across devices. Additionally, the app had to cater to varied customer segments such as senior citizens and premium users, offering them dedicated support features.

What was your solution or approach?

Implemented secure login with MPIN and device-based authentication.

Designed a tab-based UI for easy access to banking modules.

Enabled viewing of cheque return reasons, mini statements, and debit card transactions.

Integrated Anmol rewards and alerts for RD maturity, instruction failures, and locker arrears.

Added SMS/email alerts for new device logins.

Enabled call-back support for premium customers.

Streamlined net-banking claims submission.

Built a currency conversion calculator.

Added access to Insurance and Social Security Schemes.

What was the outcome or impact for the client?

Enabled 24/7 access to non-financial services.

Improved security and user confidence.

Delivered a user-friendly, efficient experience.

Reduced branch visits, supporting green banking.

Elevated service for premium users.

Simplified digital banking processes.

Other case studies from Mallow Technologies Private Limited

Other mobile app development case studies

Mobile App Development

Mobile App Development

KKodexo Labs

Wattba – Smart Appointment Management Solution

DesignMobile DevelopmentQA and Testing

Mobile App Development

KKodexo Labs

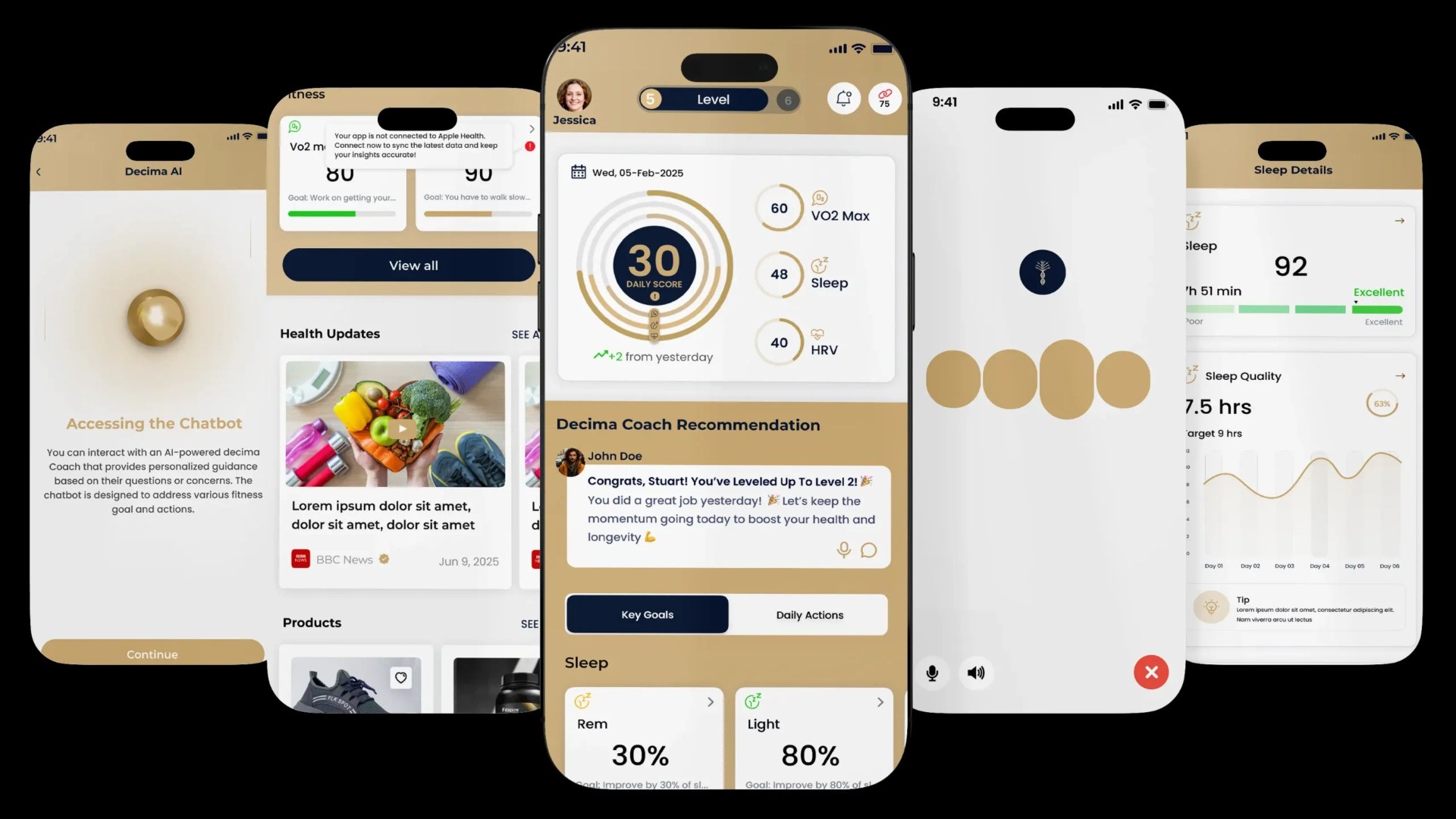

Decima | AI-Powered Health Coaching Platform

Mobile App DevelopmentSoftware DevelopmentAI Development+2

Mobile App Development

Mobile App Development

Mobile App Development

CCassovia Code

Development of a SMART App for Performing Car Inspections

ReactReact NativePHP

Project Details

Need similar services?

Agencies providing mobile app development

Posted this

M

Leveraging Technology

k

KD Software Pvt Ltd is a Leading Website Designing company in bengaluru, Greater bengaluru.

4

Designing and Developing Digital Solutions for Brands

Q

Increasing Business Success with Quality Solutions

C

Establishing online presence through innovative digital solutions.

N

Transforming Digital Experience Across Industries

Y

A Trusted Software Development Company in the USA for Scalable Digital Growth

A

Customized software development solutions for a digital world.

N

F

Building digital experiences that engage and convert

C

Your professional tech department for web and software development.